Recognizing the Value of Financial Offshore Accounts for Company Growth

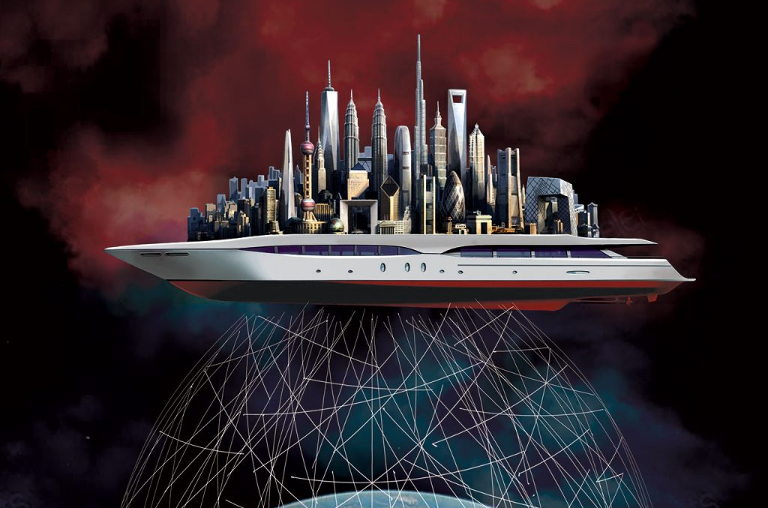

In the dynamic globe of global business, economic overseas accounts stand as essential devices for service development, offering not just better currency flexibility yet also possible decreases in transaction prices. These accounts facilitate access to diverse markets, allowing companies to utilize better rates of interest and tax obligation effectiveness. However, the strategic application of such accounts requires a nuanced understanding of lawful structures to ensure compliance and maximize advantages. This intricacy welcomes more exploration into exactly how services can properly harness the advantages of offshore banking to drive their growth initiatives.

Secret Benefits of Offshore Financial Accounts for Services

While many organizations seek affordable advantages, making use of overseas monetary accounts can provide substantial benefits. These accounts contribute in promoting global profession by enabling firms to handle numerous currencies more effectively. This capability not only enhances transactions yet can likewise lower the deal costs that stack up when handling global exchanges. Furthermore, overseas accounts usually supply much better rate of interest contrasted to domestic banks, improving the capacity for earnings on idle funds.

Furthermore, geographical diversification inherent in offshore financial can work as a danger management device. By spreading out properties throughout different jurisdictions, companies can secure against regional economic instability and political threats. This approach ensures that the company's capital is protected in differing market problems. The privacy given by some overseas jurisdictions is a crucial variable for services that prioritize discretion, especially when dealing with sensitive deals or exploring brand-new ventures.

Lawful Considerations and Conformity in Offshore Banking

Although overseas monetary accounts supply numerous advantages for services, it is important to understand the lawful structures and compliance demands that control their use. Each territory has its own collection of regulations and policies that can dramatically impact the efficiency and validity of overseas banking activities. financial offshore. Organizations have to ensure they are not just following the legislations of the nation in which the overseas account lies but likewise with worldwide economic regulations and the legislations of their home country

Non-compliance can check this cause extreme legal effects, including charges and criminal fees. It is essential for services to involve with legal professionals who specialize in international finance and tax legislation to browse these complicated lawful landscapes efficiently. This support assists make certain that their overseas financial tasks are performed legally and ethically, aligning with read the article both international and nationwide criteria, hence guarding the firm's reputation and financial health.

Techniques for Incorporating Offshore Accounts Into Company Workflow

Integrating overseas accounts into company operations needs careful planning and tactical implementation. It is essential to choose the best territory, which not only straightens with the company objectives however additionally uses financial and political stability.

Companies must incorporate their offshore accounts into their overall monetary systems with openness to keep trust among stakeholders. By systematically carrying out these approaches, businesses can effectively utilize offshore accounts to sustain their development efforts while sticking to moral and lawful standards.

Conclusion

In final thought, offshore monetary accounts are crucial assets for businesses aiming to broaden worldwide. They not only help with exceptional currency administration and lower deal costs yet additionally use appealing rates of interest and essential risk diversity. When used sensibly, considering legal structures and compliance, these accounts improve funding preservation and maximize tax obligation effectiveness. Integrating them into company procedures tactically can substantially enhance cash money circulation and line up with wider business development goals.

In the vibrant globe of worldwide business, financial offshore accounts stand as pivotal tools for business growth, providing not only better visit here money versatility but additionally possible decreases in transaction costs.While several organizations look for competitive benefits, the usage of offshore economic accounts can give considerable benefits.Although overseas monetary accounts use many benefits for businesses, it is critical to recognize the legal frameworks and conformity needs that regulate their usage. Organizations need to ensure they are not just complying with the regulations of the country in which the overseas account is located yet likewise with worldwide financial laws and the legislations of their home nation.